Price weighted index formula

W_iP frac P_i sum_i1NP_i Where. W i fraction of the portfolio that is allocated to the.

Simple Index And Weight Index Examples In R

1 Adjustment Factor Index.

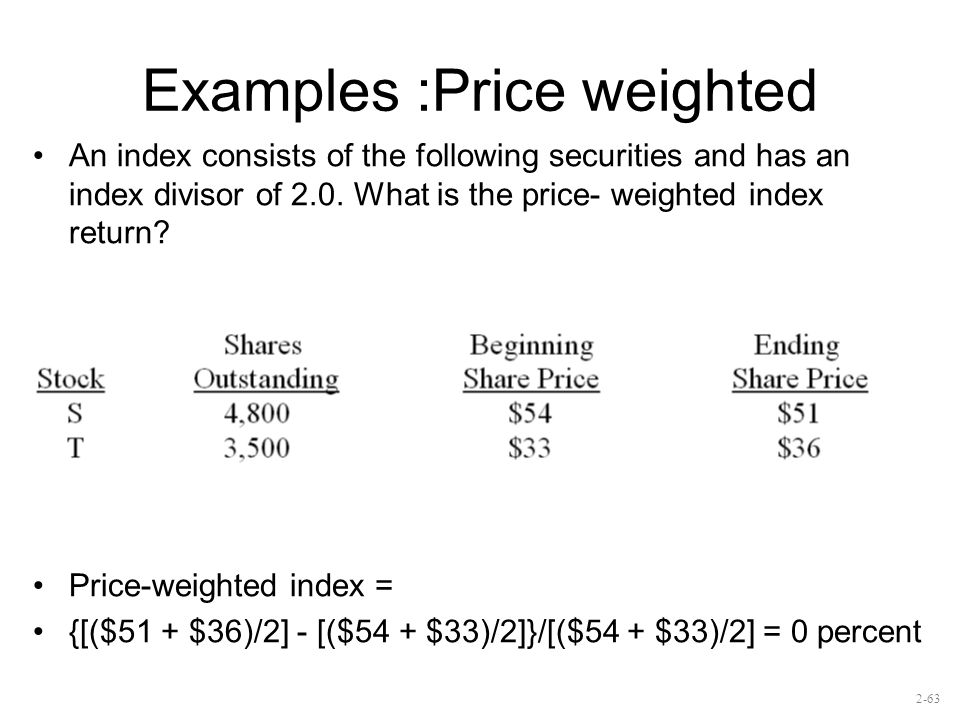

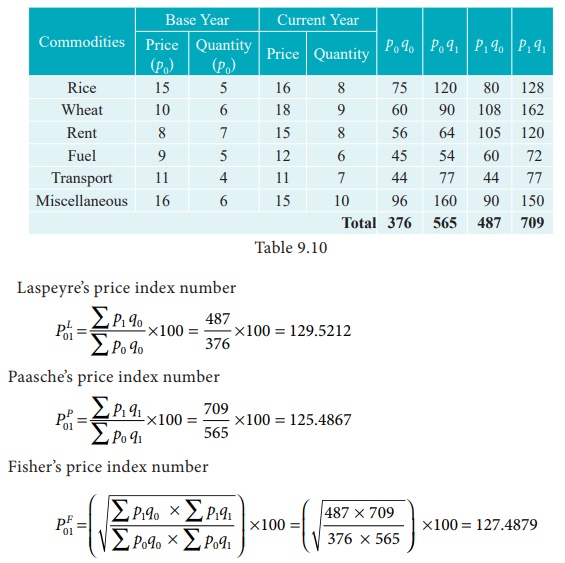

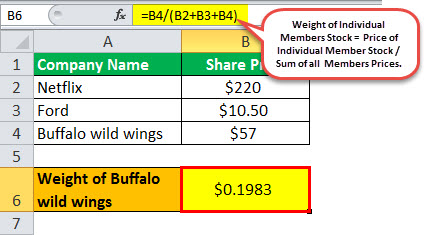

. The weight of each stock in a price-weighted index can be calculated by dividing its stock price per share by the sum of share prices of all the stocks in the index. Finishing the example multiply 01 by 100 to find the rate of return on the price-weighted index is 10 percent. The formula for the Laspeyres Price Index is as follows.

Price index numbers are usually. P_ 01L frac sum p_1 q_0 sum p_0 q_0 times 100 The advantage of the Laspeyres formula is that the quantity. Pi0 is the price of the individual item at the base period and Pit is the price of the individual item at the.

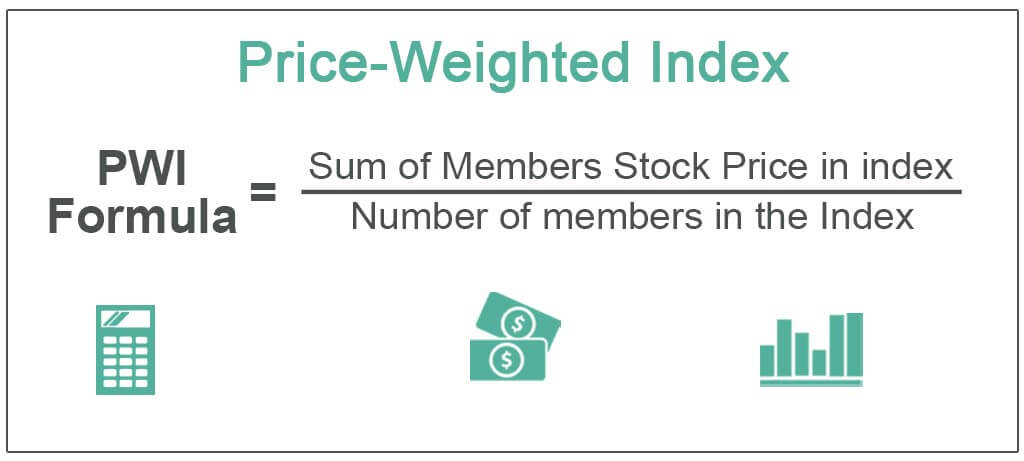

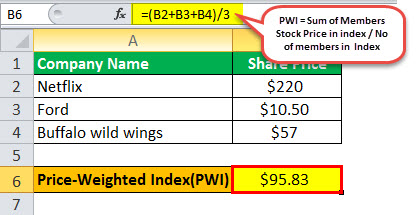

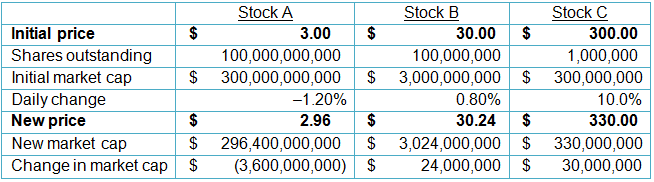

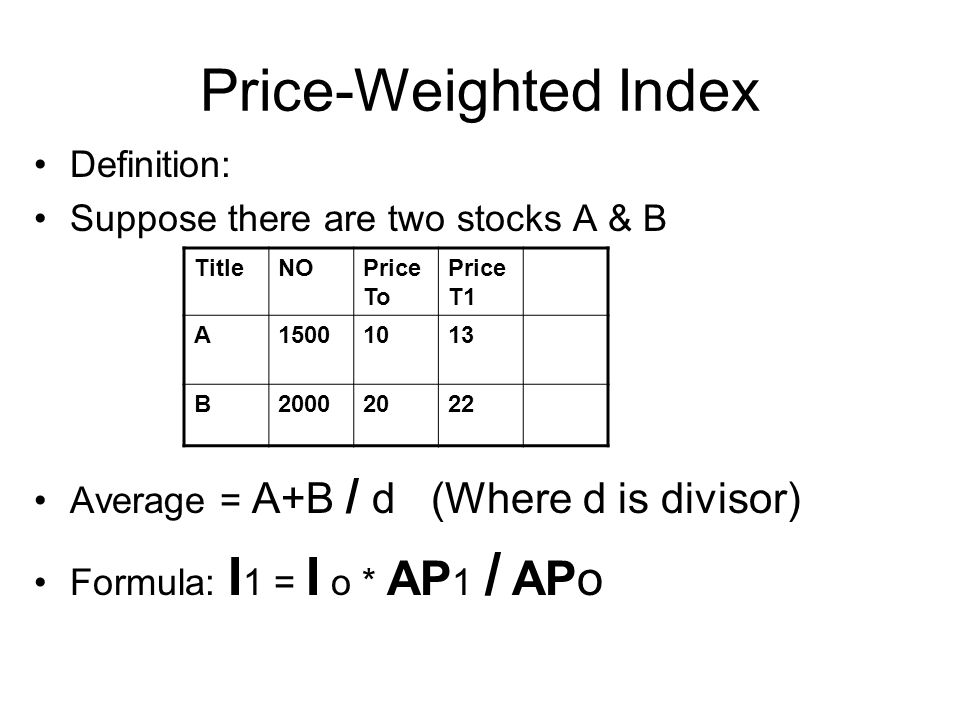

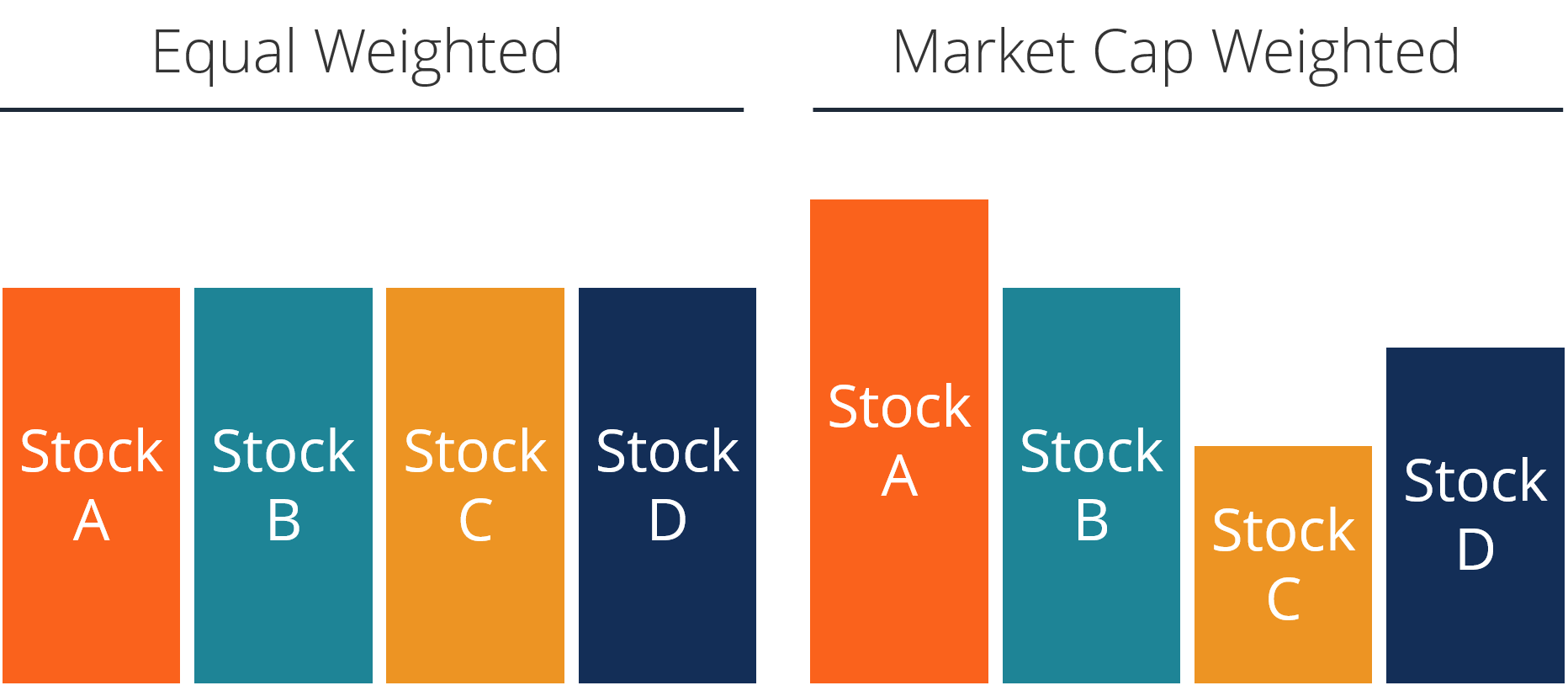

A price index aggregates various combinations of base period prices later period prices base period quantities and later period quantities. To calculate the value of a value-weighted index sum the market capitalization for each company and divide it by a divisor which is set initially to make the index a round number. PWI Formula Sum of Members Stock Price in index Number of members in the Index Weight i Price of Stock i Sum of all the Members Prices.

The formula for the index is as follows. Thus in our example the XYZ index is. 5 7 10 20 1.

VPRI the value of the price return index. Formula for the Paasche Price Index. Here the weight of each security i is given by.

A price-weighted index is simply the sum of the members stock prices divided by the number of members. Regardless of how many shares you have of each stock or the actual trading price look at the percentage of price movement. V P RI N i1niP i D V P R I i 1 N n i P i D.

A price-weighted index is a stock market index where each constituent makes up a fraction of the index that is proportional to its component the value would be. Price-Weighted Index PWI Formula. To calculate a price-weighted average or any arithmetic average for that matter simply add the numbers stock prices together and then divide by the number of stocks in the.

The Laspeyres price index is given by. The formula for calculating the value of a price return index is as follow. Pi0 is the price of the individual item at the base period and Pit is the price of the.

Multiply the result by 100 to convert the return rate to a percentage. The value-weighted index formula is I dfrac current market cap base market cap times base value. So if ABC is up 50 and XYZ is up 10 and MNO is.

How To Calculate Price Weighted Stock Market Index

Introduction To Fundamentally Weighted Index Investing

Weighted Aggregate Price Index Mba Lectures

Introduction To Fundamentally Weighted Index Investing

Equally Weighted Index Financial Edge

Price Weighted Index Formula Examples How To Calculate

Price Weighted Index Formula Examples How To Calculate

Price Weighted Index Return Youtube

How To Calculate Value Weighted Index

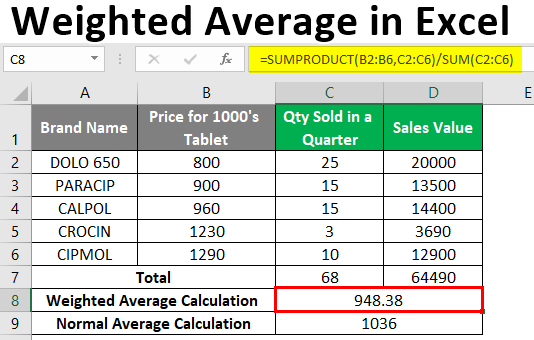

Weighted Average In Excel How To Calculate Weighted Average In Excel

Does It Matter How An Index Is Put Together

Weighted Index Number Definition Solved Example Problems Applied Statistics

Solved Price Weighted Index Constructed With The Three Stocks 2 What Is The Value Weighted Index Constructed With The Three Stocks Using A Divis Course Hero

Stock Market Index Ppt Video Online Download

Equal Weighted Index Definition Advantages And Disadvantages

:max_bytes(150000):strip_icc()/dotdash_Final_Equal_Weight_Apr_2020-01-6b2bdb8ccaf74b8d9170fafe5851d5df.jpg)

Equal Weight Definition

Price Weighted Index Formula Examples How To Calculate