Estimated payroll tax calculator

Free salary hourly and more paycheck calculators. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

See your tax refund estimate.

. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. To calculate the payroll tax youll need to apply to your employees wages follow these simple instructions and youll have a quick estimate of the true cost of each employee on your payroll. This number is the gross pay per pay period.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding forms. Subtract any deductions and. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

For example if you earn 2000week your annual income is calculated by. Taxable income Tax rate Tax liability Step 5 Additional withholdings Once you have worked out your tax liability you minus the money you put aside for tax withholdings. If youve already paid more than what you will owe in taxes youll likely receive a refund.

To change your tax withholding amount. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or. What does eSmart Paychecks FREE Payroll Calculator do.

Your employees FICA contributions should be deducted from their wages. Use your estimate to change your tax withholding amount on Form W-4. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. Or keep the same amount. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

After You Use the Estimator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Both you and your employee will be taxed 62 up to 788640 each with the current wage base.

Get an accurate picture of the employees gross pay. Use our free calculator tool below to help get a rough estimate of your employer payroll taxes. Well do the math for youall you need to do is enter the.

Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your. It only takes a few seconds to. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees.

The calculator can help estimate Federal State Medicare and Social Security tax withholdings. Well calculate the difference on what you owe and what youve paid.

Payroll Tax Calculator For Employers Gusto

How To Calculate Payroll Taxes Methods Examples More

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate Federal Withholding Tax Youtube

Payroll Calculator With Pay Stubs For Excel

Paycheck Calculator Take Home Pay Calculator

Federal Income Tax Fit Payroll Tax Calculation Youtube

Paycheck Calculator Take Home Pay Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Solved W2 Box 1 Not Calculating Correctly

Enerpize The Ultimate Cheat Sheet On Payroll

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

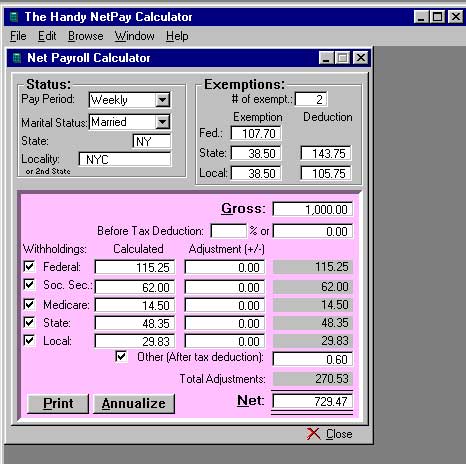

W 2 1099 Filer Software Net Pr Calculator

Medicare Tax Calculation How To Calculate Medicare Payroll Taxes Youtube

Payroll Tax What It Is How To Calculate It Bench Accounting